If you’re a first-time reader, long time follower, then you might not know exactly what Stella stands for and why month after month we choose to educate and empower our readers about business, life and maybe the most important of all… Money. We exist to change the game for women and to help balance the gender bias that is found not only in your insurance but in life at large.

It’s been a rough ride for women lately, basic funding for paid leave was struck out of the budget, and the burn-out from trying to stay on top of the cost of living with wages still not on the rise is catastrophic for women as a whole, don’t even get us started on the discussion about our reproductive rights from those who don’t even have a uterus…

But for every person that tries to hold us back, women continue to take leaps and bounds toward autonomy, and financial freedom, and our voices (though muffled by some) are growing louder and more urgent. We must regenerate and continue the conversation, in the words of Ellevest CEO Sallie Krawcheck ‘Nothing bad happens when women have more money.’

We guess before we jump right in it’s a good time to explain what feminism is and what being a financial feminist means to us. So, what are the basic feminist ideas?

The core concepts in feminist theory are sex, gender, race, discrimination, equality, difference, and choice. There are systems and structures in place that work against individuals based on these qualities and against equality and equity. You see them in your workplace, you see them in advertising, you see them when you get stung with the ‘pink tax’, heck you might even see them in your home when discussing finances with your other half.

Financial feminism addresses the gender financial inclusion gaps by engaging, educating and encouraging more women to take control of their finances, as well as raising awareness across society to support these urgent mindset changes.

Here are the 5 things you can do this year and every year to build, invest and continue to collectively get loud about money.

Tip 1. Start talking about money

That sounds obvious, right? Yet, most women still believe that talking about money is a taboo subject.

At Stella, we believe speaking openly about money is just as important as women speaking up for themselves in other areas of their life (did someone say, my body, my choice?). Talk about money to your female friends, your mum, and even your children.

Studies have proven that educating young people to have the confidence to talk about money can help to shift the bias too. Does the thought of talking about your finances make you shudder? Then start by listening to Australia’s number one money podcast She’s On the Money by Aussie finance guru Victoria Divine and you just have to take a look around the Ladies Talk Money website, they’re not only our friends here at Stella, but you’ll soon discover through their content there are a bunch of women just like you, feeling exactly the same way when it comes to their finances.

Tip 2. Advocate for equality in the workplace.

Once you’ve schooled yourself in financial literacy, it might be time to school others.. Speak up for the other women in your business and any of your non-binary workmates, advocating can include having discussions openly about wages, asking for a pay rise when you have put in the #werk and ensuring you’re being paid the same wage as your male colleagues who are in similar roles to you, it’s also worth encouraging employers to complete gender audits.

Tip 3. Invest to change the world.

Where your money goes matters, it matters for you today and it matters for the generations to come. So, look deeper into where your money is going and choose businesses that align with your values; here’s a good start to get you thinking… *Invest in renewables and energy efficacy. *Invest in clean transport *Invest in food and agriculture innovation *Invest in nature-based solutions *Invest in indigenous communities. Chat with a financial planner who can help steer you in the right direction to ensure you are putting your money where it matters.

Tip 4. Buy from businesses that give back.

We hate to toot our own horn but just last year we raised $35,000 for the Women and Girls’ Emergency Centre (WAGEC) by donating $5 from every policy sold to their Donation Program – that money provided essential material items to women and children who have experienced social disadvantage, homelessness and domestic violence. So, a simple purchase can turn into a life-changing one when you align with the right (female-led) brands.

Tip 5. Connect and advocate for your sisters

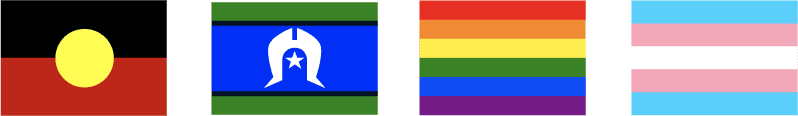

Women are a diverse group, and we must interact with, listen to, consider and support women who are disproportionately impacted by financial inequalities. This could mean reflecting on and admitting your own privilege and demanding that those who have not been given the same chance as you are also counted in your financial feminist efforts. We recommend starting with this incredible website; Closing the Women’s Wealth Gap there are a bunch of resources here to support Black, Indigenous, Latinx and other women of colour, women who are immigrants, women who are LGBTQI and other women who are economically marginalised and disadvantaged.

Defy the norms, take back the power, and smash the stigma around how you spend. In the words of our queen Lizzo, IT’S ABOUT DAMN TIME!